Market Overview

In 2019, FPC’s domestic passenger traffic grew by 3.8 million, or 3.9%.

Macroeconomic environment

| Indicators | 2019 |

| GDP | 101.3 |

| Consumer Price Index | 104.5 |

| Investment in fixed assetsJanuary — September 2019 to January — September 2018. | 100.7 |

| Real household disposable income | 100.8 |

| Real wagesJanuary — November 2019 to January — November 2018. | 102.5 |

| Unemployment (as at the end of December) percentage | 4.6 |

| Retail sales | 101.6 |

| Sales of paid retail services | 99.1 |

In 2019, the consumer price index decreased to 4.5% (vs a 2.9% inflation rate in the previous year), while GDP grew by 1.3%.

Investment in fixed assets increased by 0.7%, with the investment structure showing nominal growth in all types of fixed assets except non-residential buildings and structures. Equity remains the main source of capital investments for large and medium businesses.

Real wages grew by 2.5% driven by improvements in nominal wages. Real household disposable income increased by 0.8%.

Improvements in the labour market contributed to higher wages as unemployment declined from 4.8% in December 2018 to 4.6% in December 2019.

Russian transport market

FPC’s main competition in long-distance services is from airlines, other railway companies, coach service operators, and private transport.

The Russian transport market shows a trend for stronger competition and shrinking of areas dominated by rail as the main mode of transport.

Airlines are penetrating the segment of routes under 1,000 km by streamlining fleet operation and optimising travel costs and times.

At the same time, intercity coach services expanded on routes under 700 km, which are mostly not covered by regular trains.

In 2019, the share of rail in the total long-distance passenger traffic on domestic routes declined by 0.7 p.p. year-on-year (1.2 p.p. down from 2017). FPC’s share also decreased to 35.5% (36.4% in 2018). The downward trend is driven by an accelerated absolute growth in domestic air traffic facilitated by aggressive pricing policies of airlines, aircraft fleet renewals, route network expansion, as well as governmental support of air transport (from financing air transport infrastructure and aircraft fleet development for regional and local air carriers to providing direct subsidies for operating certain regional and long-distance routes).

| Indicators, % | 2017 | 2018 | 2019 |

| FPC | 36.9 | 36.4 | 35.5 |

| Directorate for Higher-Speed Services, a branch of Russian Railways | 1.5 | 1.6 | 1.8 |

| TransClassService | 0.5 | 0.5 | 0.4 |

| Other | 1.0 | 0.9 | 1.0 |

This leading tendency is caused by the absolute growth of transportation volume on domestic routes, helped by aggressive pricing by air carriers, the renewal of the fleet, expanding the route network and the implementation of government measures to support air transport (from the financing of the development of aviation infrastructure and aircraft fleet for regional and local air transport direct subsidies to a number of regional and long-haul routes).

FPC accounted for 93.3% of long-distance passenger traffic on domestic routes operated by Russian rail carriers in 2019

In 2019, the number of passengers carried by FPC on domestic routes increased (103.9% of the 2018 level – 102.8% in the regulated segment and 105.9% in the deregulated one).

Overall, the long-distance rail passenger services market in 2019 grew by 5.1% year-on-year. The FPC’s passenger-km on domestic routes stood at 102.5% of the 2018 level, with 102.1% in the regulated segment and 103.1% in the deregulated segment.

Growth in domestic air passenger traffic slowed down considerably in 2019 compared to 2018.

According to the Federal Agency for Air Transport (Rosaviatsiya), the total number of air passenger-km grew by 12.6% to 323 billion passenger-km in 2019. The year-on-year increase in passenger-km was 16.6% (11.1% in 2018) for international destinations and 7.4% (10% in 2018) for domestic services.

To address the negative trends and retain its competitive edge in the passenger services market, FPC works to improve customer experience, replace and upgrade its rolling stock, and accelerate trains while also focusing on its Dynamic Pricing Programme, RZD Bonus Loyalty Programme (including for corporate customers), and launching marketing promotions for both the regulated and deregulated segments.

International transport market

International long-distance passenger services

In 2019, FPC operated 11 international routes, providing direct and transit passenger services to and from 11 European and Asian countries, including Germany, France, Monaco, Poland, Austria, the Czech Republic, Italy, Finland, China, Mongolia, and North Korea. FPC also provided rail services on routes between Russia and 12 CIS and Baltic states, including Ukraine, Moldova, Belarus, Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Azerbaijan, Latvia, Lithuania, Estonia and Abkhazian.

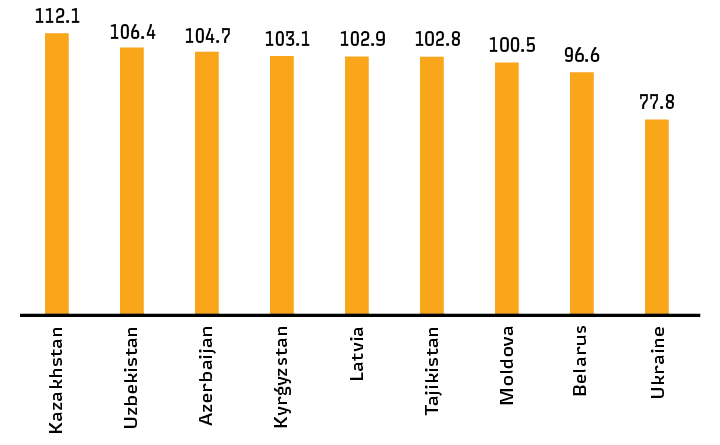

The passenger traffic between Russia and the CIS and Baltic states on trains made up by foreign railways has trended downward, with a 5.5% decline in 2019. Growth (of more than 5%) is only seen in traffic to and from Kazakhstan (12.1%) and Uzbekistan (6.4%).

To mitigate the downward trend in international passenger traffic, marketing campaigns and discount schemes are used to promote international passenger services under bi- and multilateral agreements.

The CIS and Baltic states contribute to the bulk of passenger traffic on international routes. Therefore, the declines in passenger traffic for key traffic-generating destinations affected the total passenger traffic on international routes in 2019.

Overall, international passenger traffic amounted to 97% of the 2018 level, with 95% for the CIS and Baltic states and 114% for other countries.

The key destinations generating high passenger traffic with the CIS and Baltic states are Belarus with 32% of the total number of passengers carried, Ukraine with 20% and Kazakhstan with 17%. Ukraine’s share decreased by 5% while passenger traffic between Russia and Ukraine dropped by 19% year-on-year.

The most significant year-on-year decrease in international passenger traffic was on routes to and from Ukraine (19%), Lithuania (18%), and Kyrgyzstan (11%).

The highest passenger traffic growth was on routes to and from Mongolia (18%), Finland (16%), Italy and Germany (each 7%).

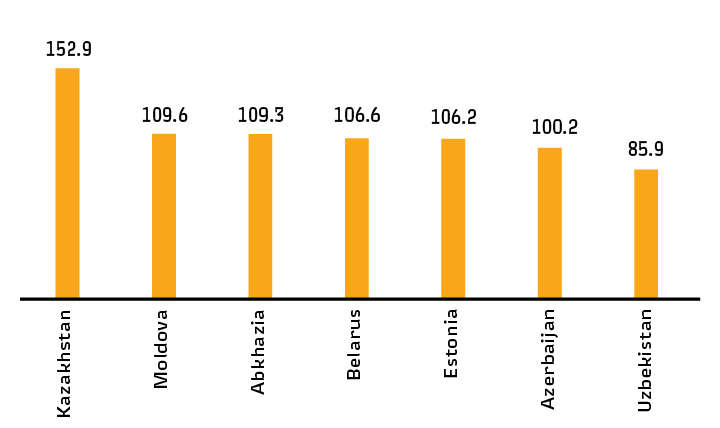

Overall, the passenger traffic on FPC’s trains in 2019 was up 11% year-on-year. The most significant growth was seen in traffic to and from Kazakhstan (52.9%), Moldova (9.6%), Abkhazia (9.3%), Belarus (6.6%), and Estonia (6.2%).